Cash Flow and Networth based Ratings

Banking Banks have been the largest databases of all consumer data and their transactions, ranging from income, utility payments and purchases for the last few decades. However, Banks’ data is stored in islands and prospective customers’ credit ratings are determined by loan repayment history of the borrower at the time of borrowing. A Loan repayment history-based Credit Rating does not represent a customer’s current cash flow and net worth. Further, such credit rating systems are ineffective in economies with large populations engaged in the informal economy.

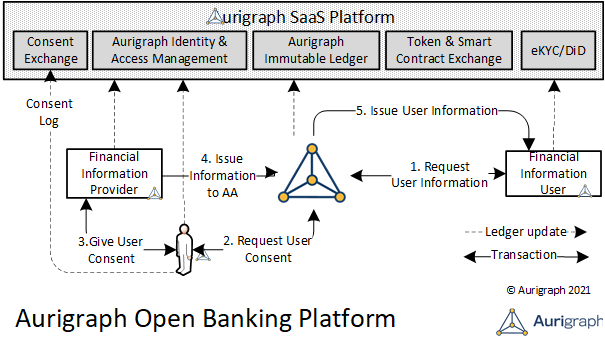

In the European Union, the United Kingdom, South Korea, Australia, and India, governments have mandated large banks to open their vast troves of customer accounts to other companies, in a bid to stimulate competition. In the United States and China, it is a market-led movement, with companies establishing open-banking relationships among themselves. Singapore is using a blend of the two models. Open Banking provides an alternative to current Credit rating systems by providing a 360° view of customers based on cash flows and assets, thus based on a customer’s current. Open Banking systems allow Requesters to seek user data through the Open Banking platform from User Data providers with User Consent. Data Providers will obtain user consent before sharing data with Requesters. Users have complete control on data being shared. The entire process maintains transparency, immutability and user privacy while providing requested data.

Over seventeen governments and central banks have passed legislation and notifications for Open Banking, opening new markets for fintech and financial services opportunities. Aurigraph Open Banking platform will enable Fintech developers, financial institutions and online lending and micro finance service providers to rapidly build applications and services to expand reach and volumes.

Aurigraph Open Banking platform

-

Aurigraph DLT is an RBI approved Sahamati Technology Services Provider for Account Aggregator.

-

Integration with over 13000 Banks, financial institutions, Sovereign Identity providers and data providers across India, Asia, Europe, and North America

-

High Availability platform ensures zero downtime

-

Super scalability with over fifty thousand Transactions per second and low latency

-

Future proof security with Post Quantum Cryptography for secure data

-

Platform to deliver low TCO Account Aggregator services.

-

-

Fixed Transaction Fee!

-

Cloud-based Open Banking SaaS

-

Aurigraph is the first DLT based open banking platform offering decentralized nodes for every individual subscriber, ensuring complete user-controlled data privacy and confidentiality. With its decentralized architecture, it offers unlimited scalability and throughput. Aurigraph Active Contracts aid in very rapid contract automation and deployments, ensuring elevated levels of compliance.

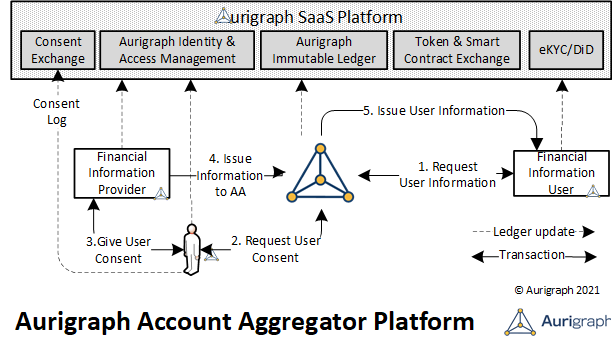

Aurigraph Account Aggregator

Users can complete their eKYC and link their financial data from various data providers to complete their 360-degree profile. When applying for any financial product or service, a financial service provider would need to merely sign a tokenized smart contract seeking a user’s financial information. The request will be routed to the respective financial information provider and delivered to the Requester after user’s consent. All activities are logged onto the Immutable Ledger, providing complete transparency, immutability, and non-repudiation. Each smart contract will be powered by Aurigraph tokens to pay for Transaction fees, taking care of fulfillment and reconciliation of the Request. Aurigraph Account Aggregator platform can reduce the cost of verification and disbursement of funds by over 90% while engaging Aurigraph using a OpEx model. The key USP of Aurigraph Account Aggregator being in-built settlement and reconciliation with extremely high throughput and low latency with real-time reconciliation and settlement