Aurigraph Finverse

Asset Tokenization for Fintech increases liquidity while streamlining processes and improving efficiencies, leading to lowering cost of Financial Inclusion

Tokenized assets are DLT-based tokens that represent the ownership over physical and digital assets. Asset tokenization is aimed to help companies leverage secure and transparent transfer of asset ownership, improved asset liquidity, fast and cost-effective asset trading. With fifty times increase predicted between 2022 and 2030, from $310 billion to $16.1 trillion, tokenized assets are expected to make up 10% of global GDP by the end of the decade.

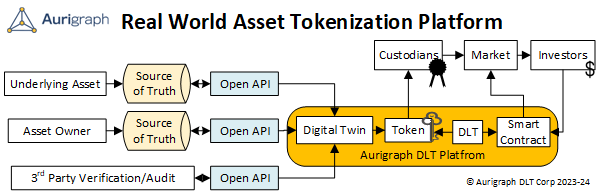

Aurigraph DLT offers the secure, safe, quick, and trusted tokenization of digital assets at a low cost and with fixed transactions fee. Assigning monetizable value and automating business value thorough ActiveContracts™ disrupts the status quo by opening several new avenues of value creation. A Digital asset may be monetized in a few minutes through Open Data integration from the single sources of truth. The monetary value of the Asset may be managed by ActiveContracts™ for value creation and transfer using NFTs, fractionalization, cross-border payments and other use cases requiring programmable currencies.

Identity Tokenization

Identity tokenization is a security technique used to protect your sensitive personal information. It works by replacing your actual data, like social security numbers or passport details, with a meaningless scrambled code called a token. This token acts as a stand-in for your real information during transactions or when stored in databases.

The core idea is to substitute your real data with a token. Aurigraph DLT generates Identity tokens using encryption algorithms that make it impossible to decipher back to the original information. The Identity token itself is stored securely, separate from your actual data which minimizes the risk of a data breach exposing your real identity information. When needed, the token can be used to retrieve your real information through a secure system. This system verifies the legitimacy of the request and ensures only authorized entities can access your data using biometrics and multi-factor authentication. By eliminating the storage of real data, hackers stealing tokens gain nothing usable, therefore reducing the risk of data breaches. Identity Tokenization can help organizations comply with data privacy regulations by minimizing the storage of sensitive personal information (PII). Identity Tokenization can replace credit card numbers during online transactions, reducing fraud risks. Businesses can use Identity tokens to streamline customer verification processes while protecting user data. Aurigraph Finverse implements ActiveContracts in Identity Tokenization with eKYC for individuals and eKYB for businesses

Investment Tokenization

Investment Tokenization will tokenize the Capital Investment on a lending platform to build on Aurigraph DLT platform using ActiveContracts. The Investment Tokens can be programmed to fractionalize and automatically transfer to a borrower. Investment Tokenization enhances liquidity by converting underlying assets into digital tokens, which makes it easier for investors to buy, sell, and trade these assets on a global scale, while reducing costs associated with transactions by eliminating intermediaries and reducing paperwork. Tokenization uses ActiveContracts to define token attributes and the responsibilities and rights of token holders making the process transparent and reducing the risk of fraud. ActiveContracts in real-world asset tokenization enable automation of the process, which reduces the need for intermediaries and paperwork. Aurigraph Finverse implements ActiveContracts in Investment Tokenization with Shared and Fixed Deposits

Accounts Receivables Tokenization

Accounts Receivables tokenization creates a token that represents an invoice or a Receivable on Aurigraph Finverse using ActiveContracts. The invoice token could be programmed to automatically transfer ownership when the underlying receivable is paid. Invoice Tokenization enhances liquidity by converting assets into digital tokens, which makes it easier for investors to buy, sell, and trade these assets on a global scale, while reducing costs associated with transactions by eliminating intermediaries and reducing paperwork. Tokenization uses Aurigraph ActiveContracts to define token attributes and the responsibilities and rights of token holders making the process transparent and reducing the risk of fraud. ActiveContracts in Real-World Asset Tokenization enable automation of the process, which reduces the need for intermediaries and paperwork. Using Aurigraph Finverse, businesses can sell the AR tokens to investors, receiving immediate payment instead of waiting for customers to settle their Receivables, thereby benefitting from greater liquidity

The entire process can be automated using ActiveContracts on Aurigraph Finverse, streamlining invoice management and reducing administrative costs. . Aurigraph Finverse implements ActiveContracts in Accounts Receivables Tokenization with Invoices and Account Receivables

Lending Tokenization

Lending tokenization is the process of using Aurigraph DLT technology to convert traditional loans into digital tokens. These tokens represent ownership or fractional ownership of the underlying loan. In a regular loan, a lender provides money to a borrower with the expectation of repayment with interest. The loan details are documented and managed by financial institutions. With the Tokenization of the Lending process, the loan details are uploaded onto a DLT that tracks transactions transparently. Once the loan is on Aurigraph Finverse, tokens are created to represent ownership (or fractional ownership) of the loan. These tokens can then be traded on a secondary market. Tokenized Lending will lead to greater Financial inclusion with the option of Fractionalized loans could allow smaller investors to participate in the lending market. Borrowers will get easier access to capital that can fuel greater economic development and consequent growth. It has the potential to revolutionize the lending landscape by making it more efficient, accessible, and transparent.

Collateral Tokenization

Collateral tokenization is a process that leverages DLT to represent ownership of assets used as security for loans or other financial agreements. These tokens act as Digital Twins for the underlying real-world asset, enabling a more efficient and transparent collateral management system. Collateral tokenization offers Traditional assets like real estate, invoices, or even securities can be tokenized, essentially creating a digital representation on a DLT. This allows for easier divisibility and tracking of ownership. The Assets need to be linked to their single source of truth. For example, in case of properties, the data should be current and bound to local government’s data electronically, to maintain the integrity of the data. Collateral transfer and management is faster and automated through smart contracts on the Aurigraph Finverse, eliminating manual paperwork and intermediaries. Tokenization can unlock the potential of previously illiquid assets like real estate to be used as collateral. Fractional ownership through tokens makes them more accessible to a wider range of lenders. Aurigraph DLT provides a secure and transparent record of ownership and transaction history for Collateral tokens, reducing risk of fraud and errors. Tokenized Collateral helps in reducing costs to both lenders and borrowers. Borrowers with illiquid assets can gain access to credit by using tokenized collateral. Tokenization opens doors for innovative financial products like decentralized lending platforms. However, Clear regulatory frameworks are needed to ensure the legitimacy and enforceability of tokenized collateral. Integrating tokenized collateral with traditional financial systems requires API integration with the single source of the truth about the credentials of the underlying asset. By increasing efficiency, transparency, and accessibility, it has the potential to unlock new opportunities for lenders and borrowers alike.