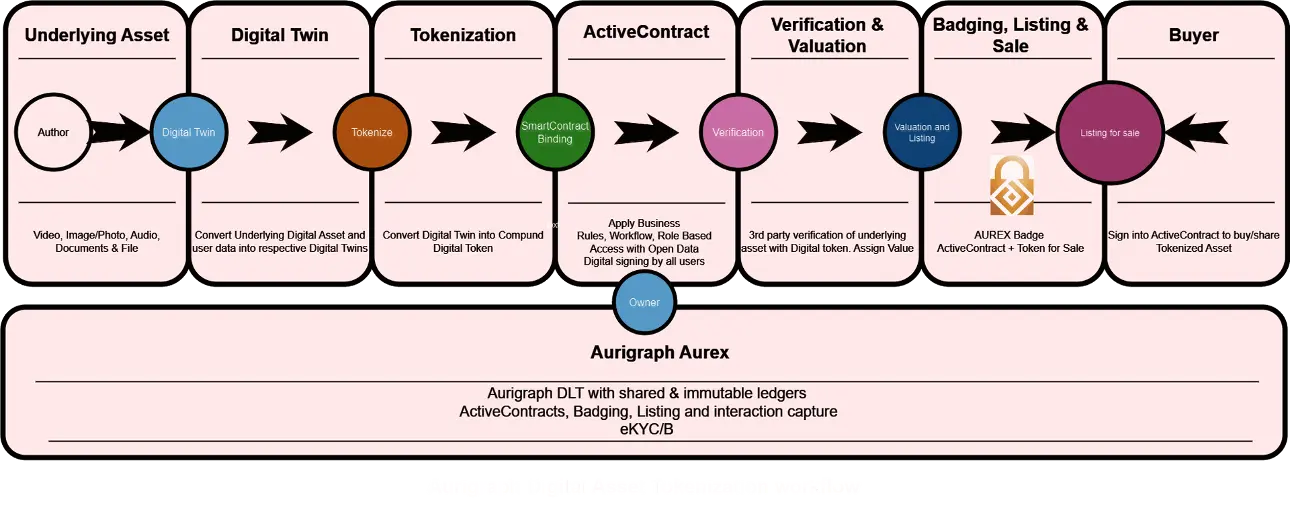

Aurigraph DLT specializes in Real World Asset Tokenization applications in Asset Tokenization for Real Estate, Digital assets, Fintech for lending, collateral, and investments, and Tokenized Carbon Credits. AUREX's Real-world Asset Tokenization platform offers Transparency and Traceability with role-based workflows while building Trust, confidentiality, and privacy of the underlying asset. Derived assets such as rentals, agricultural, and other forms of income from the underlying asset may be traded as Tokenized assets on the AUREX Marketplace

AUREX utilizes Aurigraph Real-world Asset Tokenization technology to tokenize existing assets, making them more accessible to investors while enhancing liquidity. AUREX integrates with single sources of truth using Open Data APIs from the Land Registry, eKYC, AP/AR, Approved plans, utilities, and third-party verifications and assessments to create a Digital Twin of the underlying asset. AUREX tokenizes the Digital Twins of derivative assets such as Rentals, agriculture, Carbon Credits, and other incomes to generate tokenized assets or AUREX Digital Tokens to be traded on the AUREX marketplace.

AUREX Marketplace: AUREX Digital tokens may then be traded on the AUREX marketplace through Aurigraph ActiveContracts to automate trading while maintaining the underlying assets and derivative assets' data integrity. Third-party integration such as Argus will help investors make informed decisions. This ensures Liquidity for illiquid assets such as real estate and agriculture while giving a platform to investors to widen their portfolios. AUREX will generate income through a combination of subscription, transaction, and platform fees while pursuing growth by expanding into other asset categories in newer geographies.

AUREX will operate on Aurigraph DLT and Finverse3 Marketplace platform for users to access and exchange resources and services.

- Tokenize Digital Twins: AUREX integrates with Source of Truth using OPEN APIs to generate verifiable Digital Twins of Real-world assets, which are then tokenized using Post-Quantum Cryptography to ensure very high, future-proof security.

- AUREX ActiveContracts: Aurigraph will develop, deploy, and maintain the necessary Aurigraph ActiveContracts for workflow automation with role-based access control for AUREX Tokens

- API Integration: Aurigraph will manage API integrations across government departments and industry systems, enabling seamless connectivity with external and internal databases.

- RET Registries: Create and maintain Token registries for asset tracking, smart contracts, and transaction records.

- Resource Provision for Smart Exchange: Bring innovative resources and expertise to enhance AUREX, contributing to its security, efficiency, and user experience.

- Integration with Aurigraph Carbon Markets: Aurigraph will integrate the AUREX platform with Aurigraph Carbon Markets for trading Aurigraph Carbon Tokens.

Benefits

- AUREX offers higher liquidity to illiquid assets with higher trading volumes with programmable tokens, enabling higher liquidity

- AUREX reduces the drudgery and paperwork involved in computing NAVs with integrated Finverse 3 ERP and Marketplace, thereby reducing Operational Expenses by over 30%, thereby increasing value immensely.

- Aurigraph ActiveContracts automates processes to reduce effort while increasing trade volumes and thus, revenues.

- AUREX can tokenize underlying assets with multiple derived assets separately to offer multiple monetization models

Conclusion

By digitizing Real-world assets, AUREX can facilitate liquidity and trade in an illiquid market such as real estate, agriculture, mining, Oil & Gas, to digital assets for both underlying and derived assets on the same platform. Tokenizing underlying assets ensures verifiability and traceability to build trust while tokenizing derived assets such as rental, crops, ore, O&G, energy from Solar/Wind energy and carbon credits may be tokenized to trade on marketplaces and exchanges, therefore bringing in a very high level of liquidity and funding in across geographies and markets.

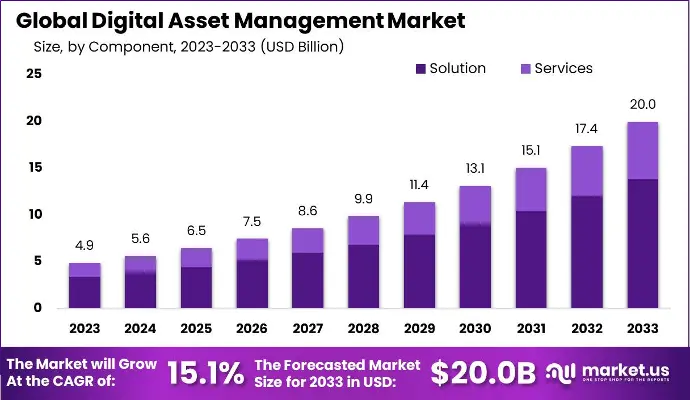

Global Digital Asset Management Market

2023: USD 4.9 Billion

2033: USD 20 Billions

CAGR of 15.1%

Source: market.us

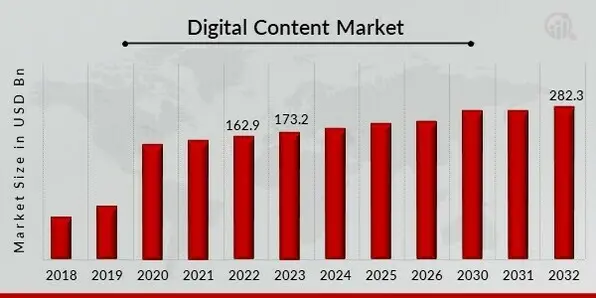

Global

Digital Content Market size 2018-2032

· 2022: USD 162.9 billion

· 2032: USD 282.3 billion

· CAGR : 6.30%

Source: Market Reseach Future

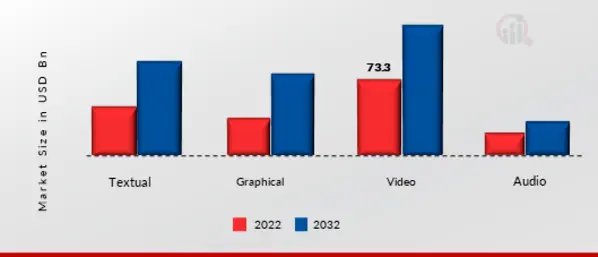

Market size by content

Video and Graphic content expected to see highest growth between 2022 and 2032

Source: Market Reseach Future

Aurex Digital Asset Tokenization marketplace for media and entertainment

Tokenizing Digital Assets can create new asset classes with corresponding monetization models. Aurigraph creates Digital Twins of any digital asset, through verified accounts and devices, using the verified data of the underlying asset and its owner(s). The Digital Twin is then tokenized and bound to Aurigraph ActiveContract along with the author and Aurigraph Aurex for listing on Aurigraph Aurex. A consumer or buyer of the Tokenized Asset may register and sign up for the ActiveContract to consume and distribute the Tokenized Asset across the internet.